Tapering Suggestions One Week Before A Marathon

Tapering Suggestions One Week Before A Marathon

Blog Article

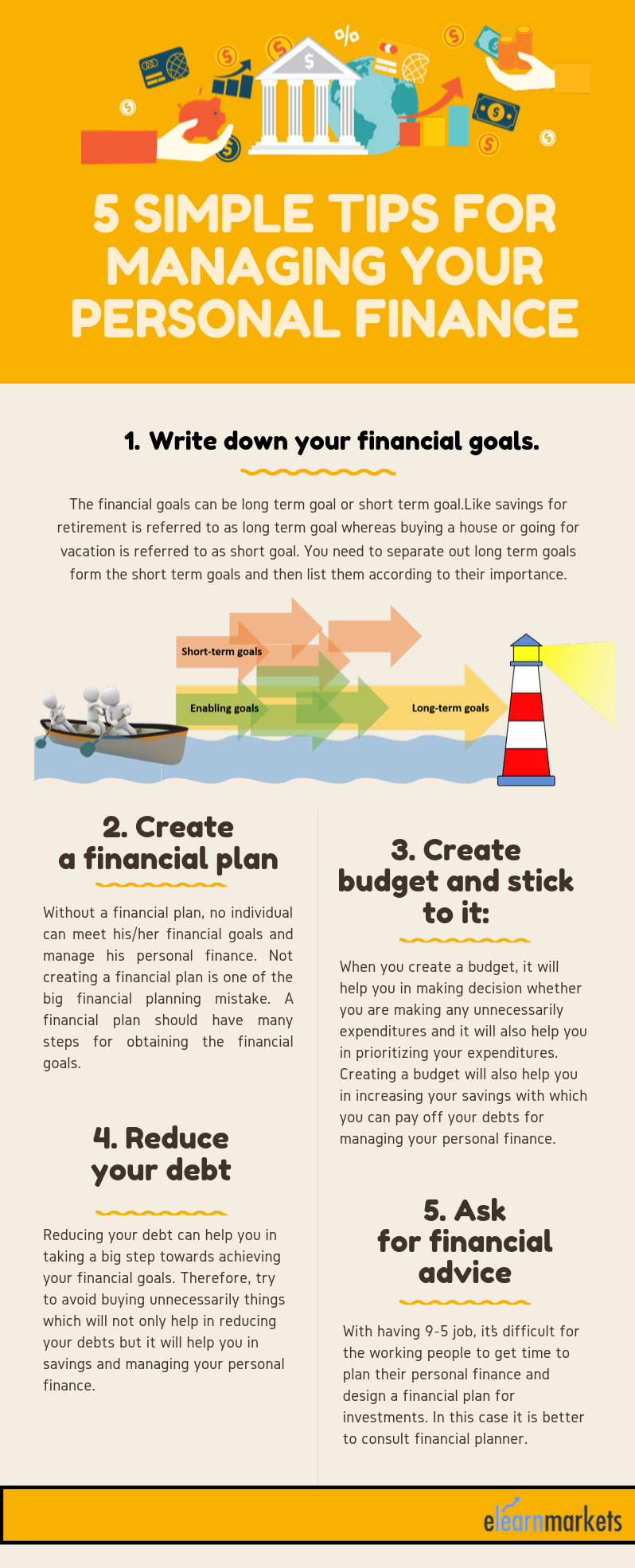

For those of you about to enter your twenties, you no doubt the sensations of pride and excitement related to main their adult years. Perhaps you have actually finally struck out by yourself with a fantastic task and a house, or perhaps you've decided to go into graduate school to further your education for something much better. While retirement seems a millennium away, this is still an excellent time to believe about the future and your present financial health. You desire to begin conserving now to have something forty years later, no matter the state of the economy. The habits you begin now toward financial duty can certainly assist you through life.

In keeping with the reality that this is the third in a trilogy of articles of physical/fiscal physical fitness examples (see footnote for other two ), and to reuse an enjoyable trick I just recently ran throughout, those lessons. each in precisely 3 words.

This is another personal finance tips basics rule however do not confuse this with an impulse buy. You have your list and know what you need, so inspect the sale display before you go shopping. Chances are you will locate that said item on sale and pay half the typical price. Food shops operate the exact same way. They typically over order products and are forced to run unadvertised specials on overstock products. Just make certain the product is on your list.

Lastly, use the 'pegging strategy' by which you work with services that are the best bang for your buck. Which is the deal dry cleaner? Where are the appetisers totally free? What time is the half-off movie show? Where do you get flowers more affordable on specific days? Know these things and spend lavishly wisely and financially.

So, when it concerns personal finance Google blogs, they do more than just help students with tips for saving money. They are a great source of information online financial advisor that students would otherwise not have and this implies that they have a better opportunity of getting the type of loan that they really need.

It is wise to start making as soon as possible, not just is the experience important, but you won't need to depend on your moms and dads. It is all the more much better if your task has something to do with managing money; this offers you money-handling experience.

When you get paid, you must take a minimum of 10% straight off the top for a savings account. In this manner, in case you lose your job or you have something happen to you that causes you not to be able to work, you are going to have some money to go on up until you alter course and get resettled. A great deal of individuals have actually struck rock bottom and never made it back up since of situations like this happening and they didn't have a cost savings to depend upon. These individual finance tips will help to end up being a better cash supervisor.